As you can see, the report format is a little bit easier to read and understand. Plus, this report form fits better on a standard sized piece of paper. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. A lender will usually require a balance sheet of the company in order to secure a business plan.

Create a Free Account and Ask Any Financial Question

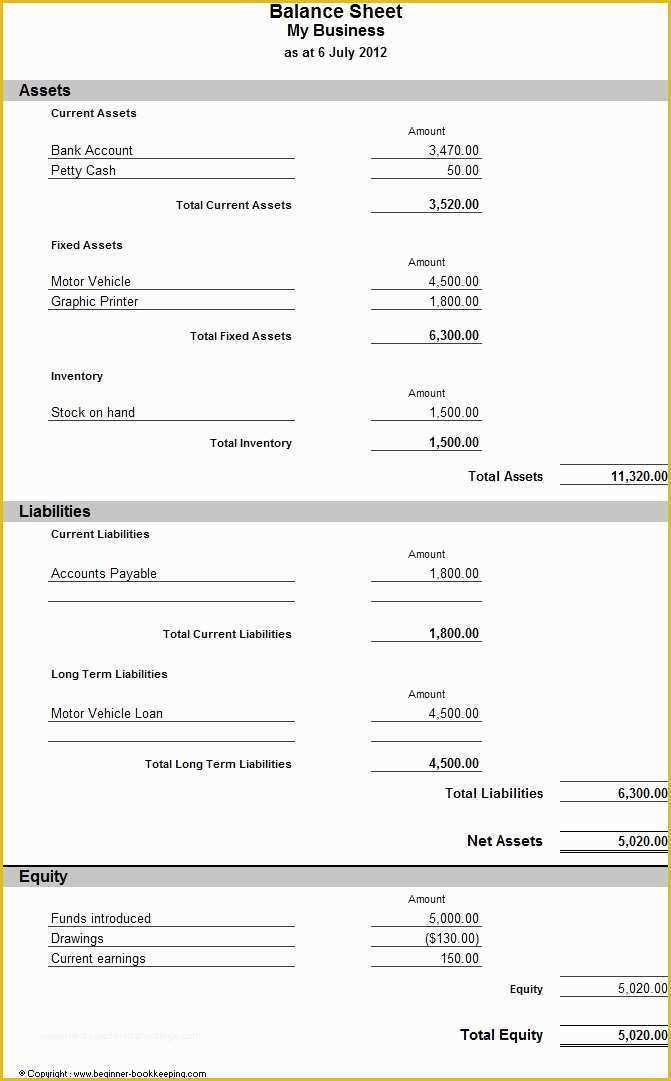

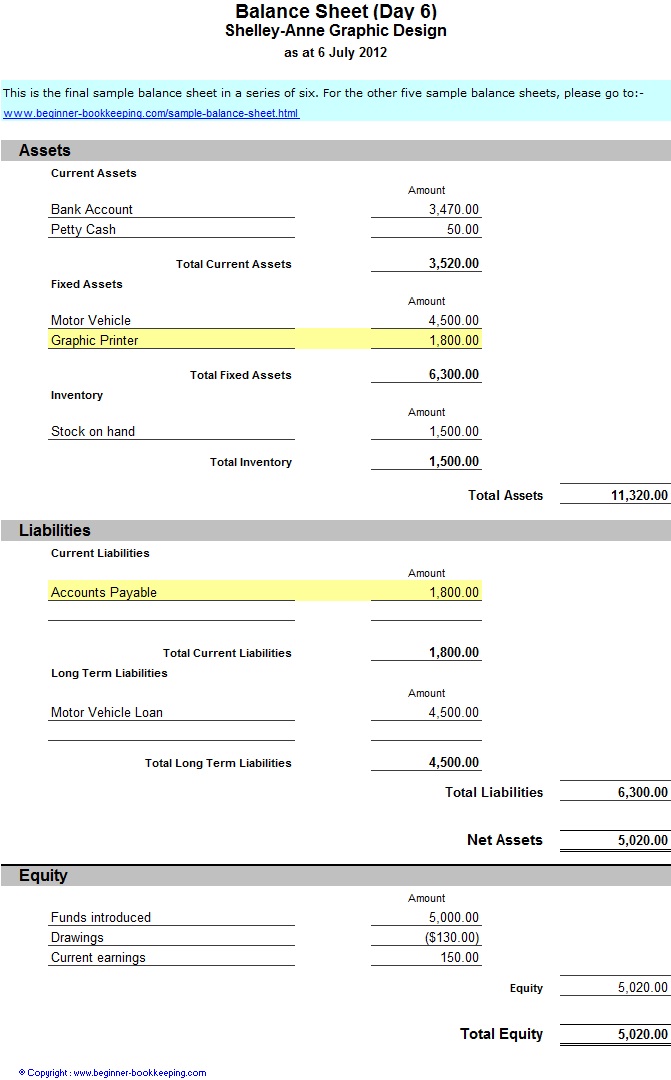

Here’s an example to help you understand the information to include on your balance sheet. In the example below, we see that the balance sheet shows assets (such as cash and accounts receivable), liabilities (such as accounts payable, credit cards, and taxes payable), and equity. Total liabilities and equity are also added up at the bottom of the sheet—hence the term ‘bottom line’ for this number. Balance sheets can tell you a lot of information about your business, and help you plan strategically to make it more liquid, financially stable, and appealing to investors.

Add Total Liabilities to Total Shareholders’ Equity and Compare to Assets

Under shareholder’s equity, accounts are arranged in decreasing order of priority. An asset is something that the company owns and that is beneficial for the growth of the business. Assets can be classified based on convertibility, physical existence, and usage. QuickBooks Online users have year-round access to QuickBooks Live Assisted Bookkeepers who can give personalized answers to bookkeeping questions and help manage their finances. Schedule a free consultation to get pricing details and walk through the service.

- Financial position refers to how much resources are owned and controlled by a company (assets), and the claims against them (liabilities and capital).

- It is one of the three core financial statements (income statement and cash flow statement being the other two) used for evaluating the performance of a business.

- You can use this report to see how your business is doing overall and whether it has enough cash to cover its expenses.

- Now that we have seen some sample balance sheets, we will describe each section of the balance sheet in detail.

Example of a balance sheet using the report form

For instance, if a company takes out a ten-year, $8,000 loan from a bank, the assets of the company will increase by $8,000. Its liabilities will also increase by $8,000, balancing the two sides of the accounting equation. Long-term assets (or non-current assets), on the other hand, are things you don’t plan to convert to cash within a year. Calculating the change in assets on a company’s balance sheet is an important step when analyzing a business or stock. The direction of these changes can be indicative of a company’s health and future prospects.

What Is Included in the Balance Sheet?

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Balance sheets also play an important role in securing funding from lenders and investors. For instance, accounts receivable should be continually assessed for impairment and adjusted to reveal potential uncollectible accounts. These ratios can yield insights into the operational efficiency of the company. It also yields information on how well a company can meet its obligations and how these obligations are leveraged. It uses formulas to obtain insights into a company and its operations.

Balance Sheets Are Subject to Several Professional Judgment Areas That Could Impact the Report

It is unsuitable for submitting to Companies House but will enable small businesses to produce a report for their year-end. If you are a limited company, you will need your accountant to format the report as part of your accounts to submit to Companies House. This ensures that the financial report adheres to the generally accepted accounting principles. To complete your balance sheet template you’ll need to add in details about the debts and liabilities your company owes. According to the equation, a company pays for what it owns (assets) by borrowing money as a service (liabilities) or taking from the shareholders or investors (equity). It’s important to note that how a balance sheet is formatted differs depending on where an organization is based.

The example above complies with International Financial Reporting Standards (IFRS), which companies outside the United States follow. In this balance sheet, accounts are listed from least liquid to most liquid (or how quickly they can be converted into cash). When the balance sheet is prepared, the liabilities section is presented first and the owners’ equity section is presented later. When a balance sheet is prepared, the current assets are listed first and non-current assets are listed later. Do you want to learn more about what’s behind the numbers on financial statements?

Balance sheets are typically prepared at the end of set periods (e.g., annually, every quarter). Public companies are required to have a periodic financial statement available to the public. On the other hand, private companies do not need to appeal to shareholders.

Balance sheets are important because they give a picture of your company’s financial standing. Before getting a business loan or meeting with potential investors, a company has to provide an up-to-date balance sheet. A potential investor or loan provider wants to see that the company is able to keep payments on time. According to the historical cost principle, all assets, with the exception of some intangible assets, are reported on the balance sheet at their purchase price. In other words, they are listed on the report for the same amount of money the company paid for them.

At a glance, you’ll know exactly how much money you’ve put in, or how much debt you’ve accumulated. Or you might compare current assets to current liabilities to make sure you’re able to meet upcoming payments. This financial statement lists everything a company owns and all of its debt. A company will be able to quickly assess whether it has borrowed too much money, whether the assets it owns are not liquid enough, or whether it has enough cash on hand to meet current demands. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders.

Balance sheets can be used with other important financial statements to conduct fundamental analysis or calculate financial ratios. Maintaining your business’s financial health is a key component of long-term success. Utilizing tools like the balance sheet and other how to do bank reconciliation financial statements will help you keep your finances in check. The balance sheet, income statement, and cash flow statement make up the three main financial statements that businesses use. Companies are required by law to generate these financial statements.